"I’m open for business, and I reflect Lexington.”

CURRENT REFLECTLEX MEMBER BUSINESSES

As facilitated by Equity Solutions Group (ESG), and sponsored by Lexington-Fayette Urban County Government, ReflectLex is a minority-business accelerator (MBA) with the goal to assist diverse-owned businesses overcome barriers that prevent the people who do business in Lexington from being a reflection of the people who live in Lexington. ReflectLex’s goals include A) identifying and preparing minority business owners to meet the needs of large customers and sizable business opportunities, thus increasing the likelihood that businesses will be “contract ready”. And B), the accelerator strives to ensure that business opportunities are converted to actual revenue.

This project is being supported, in whole or in part, by federal award numbers SLFRP0292/SLFRP3418 awarded to Lexington-Fayette Urban County Government by the U.S. Department of Treasury as part of the American Rescue Plan Act (ARPA). Specifically, the ARPA allocates funding to various programs and initiatives that provide financial assistance, grants, and loans to minority-owned businesses.

About ReflectLex: Objectives and Goals

ReflectLex builds on continued minority growth and spend trends to encourage minority business growth in two ways. First, ESG’s experienced staff and select community partners can prepare minority business owners to meet the needs of large customers and sizable business opportunities, thus increasing the likelihood that businesses will win substantial contracts with key local organizations. Second, the accelerator can connect businesses to the operating capital needed to execute against these larger opportunities. The overall objectives of the expanded Minority Business Accelerator are to:

• Identify the minority companies that are best suited to meet expectations immediately and provide the platform for them to excel.

• Create a coalition of Champions that are positioned to change the current mindset.

• Identify out-of-market minority owned companies that are willing to establish a local presence and provide infrastructure and scalability for existing local minority owned companies via joint venture agreements, operating agreements or strategic alliances.

• Implement a proven tracking and reporting system to measure progress and provide checks and balances.

• Acknowledge and reward the public and private leaders who champion this initiative.

Specific goals of the expanded Minority Business Accelerator will be, over a 3-year period, to:

1. Add a minimum of 15 (fifteen) new minority-owned businesses to the program (5/year).

2. Grow the new sales of those businesses by $15M ($5M/year).

What Businesses Learn in the ReflectLex Initiative

• Business development strategies

• Strategic planning

• Finance and financial management

• Marketing/sales

• Human resources

• Accessing capital, and contracting with the government and major corporations

History and Business Case

Key members of the Equity Solutions Group (ESG) team conducted the study, “Economic Inclusion in the Central Kentucky Region”, commissioned by Commerce Lexington and the Lexington-Fayette Urban League. Based on economic trends regarding minority growth and spending power, both nationally and within the Central Kentucky region, the report was instrumental in the creation of Commerce Lexington’s Minority Business Accelerator (MBA) program in 2013.

In 2018, based on ESG’s expertise in diversity and inclusion, the firm was hired by Commerce Lexington as a consultant to further facilitate their MBA. Since then, ESG has assisted Commerce-Lexington in nearly tripling production by participating minority-owned businesses (from $5.5 million prior to the ESG relationship for the 2013-2017 period to over $15M currently). Of that $15 million, according to Tyrone Tyra, Senior Vice President for Commerce-Lexington, ESG has been responsible for over $9 million – a 60% increase – of that growth and a 50% increase in the number of participating minority-owned businesses.

Kentucky is Mirroring National Trends as We Grow More Diverse as a State

According to the 2020 U.S. Census, ALL of U.S. population growth from 2016 to 2020 (and estimated population growth through at least 2050) comes from gains in people of color.

Fayette County has seen a 9% increase in overall population since 2010 (coincidentally adjacent Scott County had the greatest population increase in the state at 21.2% over this time period).

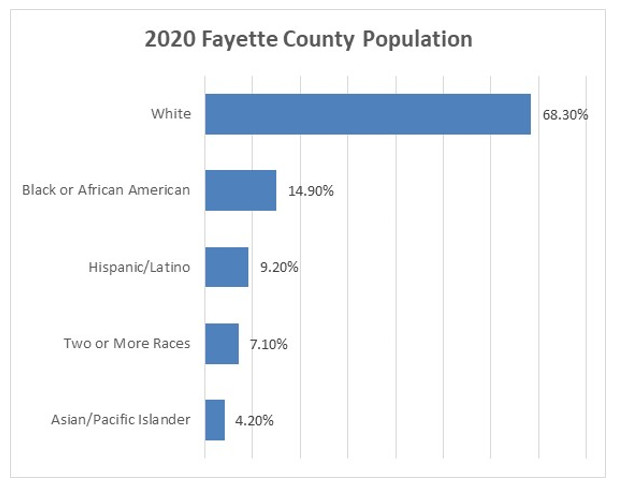

Per 2020 Census results, Fayette County residents are now 68.3% white; 14.9% Black; 4.2% Asian or Pacific Islander; 7.1% two or more races; and 9.2% Hispanic or Latino.

However, when compared to the ethnic diversity present in Kentucky communities, the percentage of minority-owned businesses is disproportionately lower.

While Black Americans make up 13 percent of the U.S. population, they own less than 2 percent of small businesses with employees. By contrast, the majority make up 60 percent of the U.S. population but own 82 percent of small employer firms. When minority-owned businesses do obtain loans, they are frequently much smaller in amount.

The average Black-owned firm obtains just $35,000 in total startup capital during its first year compared with the average of $106,000 for other businesses. While the Small Business Administration (SBA) is charged with helping all “Americans start, build, and grow businesses,” its efforts have fallen short in Black communities. Black Americans make up approximately 13 percent of the U.S. population but receive just 3 percent of SBA loans.

The coronavirus crisis has contributed to this challenge: The number of active Black-owned businesses plummeted by 41 percent between February 2020 and April 2020. Wealth at the community level is essential for the long-term success of Black-owned small businesses.

Minority business development is becoming more important as these demographic trends coupled with the implications of globalization continue to influence the Central Kentucky region’s overall economy. The makeup of the Central Kentucky region’s workforce as well as the companies that rely on the region’s workforce are becoming visibly more diverse.

Collectively, these trends provide a compelling picture of the country’s future as well as the future of Central Kentucky. The future will not look like the past; therefore, the same business practices that have been accepted for generations may not be optimal based on demographic trending.

ReflectLex will build on continued minority growth and spend trends to encourage minority business growth in two ways. First, ESG’s experienced staff and select community partners can prepare minority business owners to meet the needs of large customers and sizable business opportunities, thus increasing the likelihood that businesses will win substantial contracts with key local organizations. Second, the accelerator can connect businesses to the operating capital needed to execute against these larger opportunities.

This project is being supported, in whole or in part, by federal award numbers SLFRP0292/SLFRP3418 awarded to Lexington-Fayette Urban County Government by the U.S. Department of Treasury.